|

|

|

|

Investment Objective/Strategy - The First Trust Indxx Innovative Transaction & Process ETF, seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an index called the Indxx Blockchain Index (the "Index"). The Fund will normally invest at least 90% of its net assets (including investment borrowings) in common stocks and depositary receipts that comprise the Index. The Index is designed to track the performance of companies that are either actively using, investing in, developing, or have products that are poised to benefit from blockchain technology and/or the potential for increased efficiency that it provides to various business processes. The index seeks to include only companies that have devoted material resources to the use of blockchain technologies. The Index is owned and is developed, maintained and sponsored by Indxx, Inc. (the "Index Provider").

There can be no assurance that the Fund's investment objectives will be achieved.

-

The Indxx Blockchain Index tracks the performance of exchange-listed companies across the globe that are either actively using, investing in, developing, or have products

that are poised to benefit from blockchain technology. The index seeks to include only companies that have devoted material resources to the use of blockchain technologies.

-

Each security in the index must meet certain eligibility criteria based on liquidity, size and trading minimums.

-

Eligible securities are classified into the following three categories:

-

Tier One: Active Enablers – Companies actively developing blockchain technology products or systems for their own internal use and for the sale and support of other

companies; companies that are direct service providers for blockchain technology; or, companies that have business models that rely on delivering products or services

that use blockchain technology. Companies in this category are assigned a score of 1.

-

Tier Two: Active Users – Companies that are using blockchain technology that is generally supported by an Active Enabler or have at least one use or test case of

using blockchain technology. Companies in this category are assigned a score of 2.

-

Tier Three: Active Explorers – Companies that have publicly disclosed that they are active in exploring the incorporation of blockchain technology into their business

or have a press release on their website or a news article stating that they have started working on the blockchain technology space. These companies do not have at

least one use case or test case on blockchain technology and are not currently directly incorporating blockchain technology into their business. Companies in this

category are assigned a score of 3.

-

Companies with a score of 1 or 2 are selected for the index and weighted with Active Enablers receiving 50% and Active Users receiving 50%. The selected companies are

weighted equally within each category. The index is capped at 100 constituents.

-

A maximum weighting of 0.50% is applied to constituents in the Active Enabler category with a market cap of less than $500 million, as well as a 20 day and 3 month average

daily turnover volume of less than $3 million.

-

The Index is rebalanced and reconstituted semi-annually.

| Ticker | LEGR |

| Fund Type | Technology |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33741X201 |

| ISIN | US33741X2018 |

| Intraday NAV | LEGRIV |

| Fiscal Year-End | 09/30 |

| Exchange | Nasdaq |

| Inception | 1/24/2018 |

| Inception Price | $29.99 |

| Inception NAV | $29.99 |

| Rebalance Frequency | Semi-Annual |

| Total Expense Ratio* | 0.65% |

* As of 2/3/2025

| Closing NAV1 | $61.94 |

| Closing Market Price2 | $62.09 |

| Bid/Ask Midpoint | $62.09 |

| Bid/Ask Premium | 0.23% |

| 30-Day Median Bid/Ask Spread3 | 0.44% |

| Total Net Assets | $130,071,054 |

| Outstanding Shares | 2,100,002 |

| Daily Volume | 11,438 |

| Average 30-Day Daily Volume | 6,348 |

| Closing Market Price 52-Week High/Low | $62.69 / $42.95 |

| Closing NAV 52-Week High/Low | $62.60 / $43.07 |

| Number of Holdings (excluding cash) | 104 |

| Holding |

Percent |

| Micron Technology, Inc. |

3.42% |

| Samsung Electronics Co., Ltd. |

2.63% |

| Intel Corporation |

2.34% |

| Advanced Micro Devices, Inc. |

1.89% |

| Engie S.A. |

1.74% |

| Baidu, Inc. (ADR) |

1.70% |

| Infineon Technologies AG |

1.64% |

| Taiwan Semiconductor Manufacturing Company Ltd. (ADR) |

1.59% |

| Nordea Bank Abp |

1.50% |

| International Business Machines Corporation |

1.48% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

Among 1,059 funds in the Large Value category. This fund was rated 5 stars/1,059 funds (3 years), 3 stars/995 funds (5 years) based on risk adjusted returns.

Among 1,059 funds in the Large Value category. This fund was rated 5 stars/1,059 funds (3 years), 3 stars/995 funds (5 years) based on risk adjusted returns.

| Maximum Market Cap. | $4,531,764 |

| Median Market Cap. | $129,098 |

| Minimum Market Cap. | $7,711 |

| Price/Earnings | 16.77 |

| Price/Book | 1.98 |

| Price/Cash Flow | 11.13 |

| Price/Sales | 1.96 |

| Country |

Percent |

| United States |

38.02% |

| China |

9.61% |

| Germany |

7.48% |

| India |

6.93% |

| France |

5.28% |

| United Kingdom |

5.16% |

| Hong Kong |

2.94% |

| Switzerland |

2.90% |

| Spain |

2.68% |

| South Korea |

2.64% |

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

140 |

19 |

--- |

--- |

| Days Traded at Discount |

110 |

1 |

--- |

--- |

|

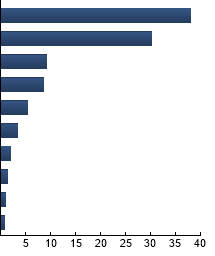

Financials

|

37.97%

|

|

Information Technology

|

30.23%

|

|

Communication Services

|

9.24%

|

|

Consumer Discretionary

|

8.65%

|

|

Industrials

|

5.32%

|

|

Utilities

|

3.31%

|

|

Materials

|

2.04%

|

|

Consumer Staples

|

1.46%

|

|

Health Care

|

1.03%

|

|

Energy

|

0.75%

|

|

|

Tracking Index: Indxx Blockchain Index

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| LEGR |

11.47% |

3.06 |

0.81 |

1.45 |

0.84 |

| S&P 500® Index |

11.95% |

--- |

1.00 |

1.41 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|