|

|

|

|

Investment Objective/Strategy - The FT Vest S&P 500® Dividend Aristocrats Target Income ETF® (the "Fund") seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an equity index called the Cboe S&P 500® Dividend Aristocrats Target Income Index Monthly Series (the "Index"). The Fund will normally invest at least 80% of its total assets (including investment borrowings) in the common stocks and call options that comprise the Index. The Fund, using an indexing investment approach, attempts to replicate, before fees and expenses, the performance of the Index. The Index is owned, developed, maintained and calculated by S&P Opco, LLC (the "Index Provider"). Vest Financial LLC is the Fund's investment sub-advisor ("Vest" or the "Sub-Advisor").

There can be no assurance that the Fund's investment objectives will be achieved.

- The index is a rules-based buy-write index designed with the primary goal of generating an annualized level of income from stock dividends and option premiums that is approximately 8% over the annual dividend yield of the S&P 500® Index and a secondary goal of generating limited capital appreciation based on the returns of the equity components of the index.

- The index is composed of two parts:

- An equal-weighted portfolio of the stocks contained in the S&P 500® Dividend Aristocrats Index (the "Aristocrat Stocks") that have options that trade on a national securities exchange.

- A rolling series of short (written) call options on each of the Aristocrat Stocks (the "Covered Calls").

- The S&P 500 Dividend Aristocrats Index generally includes companies in the S&P 500 Index that have increased dividend payments each year for at least 25 consecutive years and meet certain market capitalization and liquidity requirements.

- The Covered Calls are written (sold) by the index on the third Friday of each month with an expiration typically on the third Friday of the following month and a strike price as close as possible to the closing price of the underlying Aristocrat Stock at the time the Covered Call is written.

- The index employs a "partial covered call strategy," meaning that Covered Calls will be typically written on a notional value less than the total value of each underlying Aristocrat Stock, such that the short position in each call option is "covered" by a portion of the corresponding Aristocrat Stock held by the index.

- The equity portion of the Index is rebalanced quarterly and reconstituted annually.

| Ticker | KNG |

| Fund Type | Target Income Strategies® |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | Vest Financial, LLC |

| CUSIP | 33739Q705 |

| ISIN | US33739Q7051 |

| Intraday NAV | KNGIV |

| Fiscal Year-End | 10/31 |

| Exchange | Cboe BZX |

| Inception | 3/26/2018 |

| Inception Price | $40.00 |

| Inception NAV | $40.00 |

| Total Expense Ratio* | 0.75% |

* As of 3/3/2025

The Investment Advisor has implemented fee breakpoints, which reduce the fund's investment management fee at certain assets levels. Please see the fund's Statement of Additional Information for full details.

On March 1, 2021, the Cboe Vest S&P 500® Dividend Aristocrats Target Income ETF (the "Target Fund") was reorganized into the FT Vest S&P 500® Dividend Aristocrats Target Income ETF (the “Acquiring Fund”). Pursuant to the reorganization, the assets of the Target Fund were transferred to, and the liabilities of the Target Fund were assumed by, the Acquiring Fund. The Target Fund was incepted on March 26, 2018. The Acquiring Fund was incepted on February 24, 2021.

| Closing NAV1 | $49.20 |

| Closing Market Price2 | $49.23 |

| Bid/Ask Midpoint | $49.20 |

| Bid/Ask Premium | 0.00% |

| 30-Day Median Bid/Ask Spread3 | 0.04% |

| Total Net Assets | $3,447,729,903 |

| Outstanding Shares | 70,075,000 |

| Daily Volume | 664,333 |

| Average 30-Day Daily Volume | 410,309 |

| Closing Market Price 52-Week High/Low | $51.88 / $45.30 |

| Closing NAV 52-Week High/Low | $51.83 / $45.21 |

| Number of Holdings (excluding cash) | 136 |

| Holding |

Percent |

| Albemarle Corporation |

2.06% |

| Expeditors International of Washington, Inc. |

1.81% |

| C.H. Robinson Worldwide, Inc. |

1.79% |

| Cardinal Health, Inc. |

1.78% |

| Nucor Corporation |

1.70% |

| Dover Corporation |

1.68% |

| Caterpillar Inc. |

1.64% |

| Kenvue Inc. |

1.63% |

| Chubb Limited |

1.61% |

| Brown-Forman Corporation |

1.55% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $881,080 |

| Median Market Cap. | $41,033 |

| Minimum Market Cap. | $8,517 |

| Price/Earnings | 22.90 |

| Price/Book | 3.10 |

| Price/Cash Flow | 15.73 |

| Price/Sales | 1.75 |

Market cap and price ratio statistics are for the equity portion of the fund and exclude cash and options.

| Option Overwrite % | 21.61% |

| Current Month Upside Participation % | 78.39% |

| ATM Short Call Maturity | 12/19/25 |

Option Overwrite % is the percentage of the net asset value used for writing of call options against a long position at each monthly call selling date. Current Month Upside Participation % is the percentage of participation in the price returns of the underlying instrument at each monthly call selling date. ATM (At the Money) Short Call Maturity is when an options price is identical to the current price of the underlying security. The ATM short call produces premium income for the fund which expires on the maturity date.

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

215 |

44 |

43 |

48 |

| Days Traded at Discount |

37 |

16 |

19 |

16 |

|

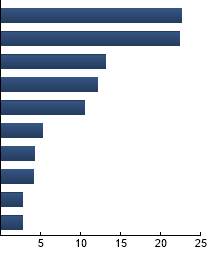

Consumer Staples

|

22.58%

|

|

Industrials

|

22.35%

|

|

Financials

|

13.07%

|

|

Materials

|

12.17%

|

|

Health Care

|

10.55%

|

|

Utilities

|

5.23%

|

|

Consumer Discretionary

|

4.30%

|

|

Real Estate

|

4.18%

|

|

Energy

|

2.80%

|

|

Information Technology

|

2.77%

|

|

|

Tracking Index: Cboe S&P 500® Dividend Aristocrats Target Income Index Monthly Series

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| KNG |

12.05% |

-9.40 |

0.71 |

0.09 |

0.74 |

| S&P 500® Dividend Aristocrats Index |

13.17% |

-9.26 |

0.77 |

0.17 |

0.74 |

| S&P 500® Index |

12.69% |

--- |

1.00 |

1.18 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

S&P 500® Dividend Aristocrats Index - The Index consists of companies from the S&P 500 Index that have increased dividends every year for at least 25 consecutive years. S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance.

A written (sold) call option gives the seller the obligation to sell shares of the underlying asset at a specified price (strike price) at a specified date (expiration date). The writer (seller) of the call option receives an amount (premium) for selling the option. In the event the underlying asset appreciates above the strike price as of the expiration date, the seller of the call option will have to pay the difference between the value of the underlying asset and the strike price (which loss is offset by the premium initially received), and in the event the underlying asset declines in value, the call option may end up worthless and the seller of the call option retains the premium.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|