|

|

|

|

Investment Objective/Strategy - The First Trust Large Cap Value AlphaDEX® Fund is an exchange-traded fund. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the Nasdaq AlphaDEX Large Cap Value™ Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- The Index is an "enhanced" index created and administered by Nasdaq, Inc. ("Nasdaq") which employs the AlphaDEX® stock selection methodology to select stocks from the Nasdaq US 500 Large Cap Value™ Index that meet certain criteria.

- Nasdaq constructs the Index by ranking the eligible stocks from the Nasdaq US 500 Large Cap Value™ Index on growth factors including 3-, 6- and 12- month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors. A stock must have data for all growth and/or value factors to receive a rank for that style.

- Each stock receives either its growth or value score as its selection score based on its style designation as determined by Nasdaq. Only those stocks designated as value stocks are eligible for the portfolio.

- The top 187 stocks based on the selection score determined in the previous step comprise the "selected stocks". The selected stocks are divided into quintiles based on their rankings and the top ranked quintiles receive a higher weight within the index. The stocks are equally-weighted within each quintile.

- The Index is reconstituted and rebalanced quarterly.

| Ticker | FTA |

| Fund Type | Large Cap Value |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33735J101 |

| ISIN | US33735J1016 |

| Intraday NAV | FTAIV |

| Fiscal Year-End | 07/31 |

| Exchange | Nasdaq |

| Inception | 5/8/2007 |

| Inception Price | $30.00 |

| Inception NAV | $30.00 |

| Rebalance Frequency | Quarterly |

| Total Expense Ratio* | 0.58% |

| Net Expense Ratio* | 0.58% |

* As of 12/1/2025

Expenses are capped contractually at 0.70% per year, at least through November 30, 2026.

| Closing NAV1 | $92.44 |

| Closing Market Price2 | $92.42 |

| Bid/Ask Midpoint | $92.42 |

| Bid/Ask Discount | 0.03% |

| 30-Day Median Bid/Ask Spread3 | 0.04% |

| Total Net Assets | $1,261,860,346 |

| Outstanding Shares | 13,650,002 |

| Daily Volume | 29,664 |

| Average 30-Day Daily Volume | 43,128 |

| Closing Market Price 52-Week High/Low | $93.00 / $67.12 |

| Closing NAV 52-Week High/Low | $93.04 / $67.02 |

| Number of Holdings (excluding cash) | 187 |

| Holding |

Percent |

| SLB Ltd. |

1.09% |

| Exxon Mobil Corporation |

1.02% |

| CF Industries Holdings, Inc. |

0.99% |

| Chevron Corporation |

0.99% |

| Devon Energy Corporation |

0.99% |

| Coterra Energy Inc. |

0.97% |

| Verizon Communications Inc. |

0.97% |

| PulteGroup, Inc. |

0.96% |

| Target Corporation |

0.95% |

| ConocoPhillips |

0.94% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

Among 384 funds in the Mid-Cap Value category. This fund was rated 3 stars/384 funds (3 years), 4 stars/365 funds (5 years), 4 stars/297 funds (10 years) based on risk adjusted returns.

Among 384 funds in the Mid-Cap Value category. This fund was rated 3 stars/384 funds (3 years), 4 stars/365 funds (5 years), 4 stars/297 funds (10 years) based on risk adjusted returns.

| Maximum Market Cap. | $1,037,556 |

| Median Market Cap. | $33,892 |

| Minimum Market Cap. | $11,904 |

| Price/Earnings | 15.15 |

| Price/Book | 1.97 |

| Price/Cash Flow | 9.01 |

| Price/Sales | 1.33 |

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

65 |

6 |

--- |

--- |

| Days Traded at Discount |

185 |

18 |

--- |

--- |

|

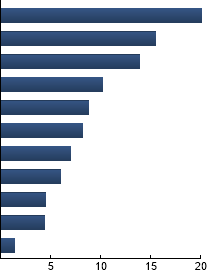

Financials

|

20.13%

|

|

Energy

|

15.53%

|

|

Utilities

|

13.88%

|

|

Health Care

|

10.16%

|

|

Industrials

|

8.78%

|

|

Materials

|

8.15%

|

|

Consumer Discretionary

|

6.95%

|

|

Consumer Staples

|

6.02%

|

|

Information Technology

|

4.54%

|

|

Communication Services

|

4.41%

|

|

Real Estate

|

1.45%

|

|

|

Tracking Index: Nasdaq AlphaDEX Large Cap Value™ Index

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FTA |

14.73% |

-4.41 |

1.09 |

0.51 |

0.94 |

| S&P 500® Value Index |

12.60% |

--- |

1.00 |

0.86 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Nasdaq US 500 Large Cap Value™ Index - The Index is a float modified market capitalization weighted index that includes value securities from the Nasdaq US 500 Large Cap™ Index. S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance. S&P 500® Value Index - The Index contains those securities with value characteristics from the S&P 500 Index.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|