|

|

|

|

Investment Objective/Strategy - The First Trust Bloomberg Nuclear Power ETF (the "Fund") seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an index called the Bloomberg Nuclear Power Index (the "Index"). Under normal market conditions, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in the securities that comprise the Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- The Bloomberg Nuclear Power Index measures the performance of companies based on their expected revenue exposure to nuclear-related activities, as well as operational and financial factors including a company’s ability to scale production, capital allocation trends, customer relationships, and access to capital. Companies must also belong to one or more of the following exposure categories within the Nuclear Power Ecosystem, as determined by Bloomberg Intelligence (“BI”).

- Power Generation: Companies that are regulated utilities and merchant-power producers that operate nuclear-generation assets.

- Uranium: Companies involved in mining and enrichment of uranium for use in nuclear fuel.

- Equipment & Engineering, Procurement and Construction: Companies engaged in engineering or construction services for nuclear power plants, reactor manufacturing, managing nuclear waste, or providing other equipment or services for nuclear power generation.

- The index begins with a universe of all the securities comprising the Bloomberg World Aggregate Universe.

- Through BI’s review and analysis process, companies are scored based on the sum of combined Revenue and Theme Assessments which reflect a company’s current and potential near-term revenue exposure to the Nuclear Power ecosystem and positioning and ability to execute within the Nuclear Power ecosystem competitive landscape, according to BI.

- The index provider assigns a company into a “Gold,” “Silver,” or “Bronze” Tier based on the combined Revenue and Theme Assessment using data from BI. Only companies within the Gold Tier, which have the highest exposure to the Nuclear Power Ecosystem, are eligible for index inclusion.

- According to the index provider, a company must belong to at least one or more of the exposure categories (detailed above) to be eligible for inclusion. A security must also meet minimum issuer free float market capitalization and liquidity requirements and be listed on a Bloomberg Global Equity Exchange:

- From the list of eligible securities within the Gold Tier, the securities with the highest Revenue Assessment are selected for inclusion in order of largest to smallest free float market capitalization.

- The top 50 securities in the sorted list are selected for inclusion in the index and considered “Nuclear Power” companies.

- The index uses a modified market capitalization weighting approach, which adjusts each company’s market capitalization based on its Revenue Assessment and issuer free float market capitalization.

- No single security will have a weight greater than 4.5% or less than 0.25%.

- The index is rebalanced and reconstituted quarterly.

| Ticker | RCTR |

| Fund Type | Alternative Energy |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33734X721 |

| ISIN | US33734X7214 |

| Fiscal Year-End | 09/30 |

| Exchange | NYSE Arca |

| Inception | 7/30/2025 |

| Inception Price | $30.22 |

| Inception NAV | $30.22 |

| Rebalance Frequency | Quarterly |

| Total Expense Ratio* | 0.70% |

* As of 2/2/2026

| Closing NAV1 | $38.33 |

| Closing Market Price2 | $38.25 |

| Bid/Ask Midpoint | $38.29 |

| Bid/Ask Discount | 0.10% |

| 30-Day Median Bid/Ask Spread3 | 0.70% |

| Total Net Assets | $23,000,393 |

| Outstanding Shares | 600,002 |

| Daily Volume | 1,251 |

| Average 30-Day Daily Volume | 7,240 |

| Closing Market Price 52-Week High/Low | $38.41 / $29.70 |

| Closing NAV 52-Week High/Low | $38.41 / $29.55 |

| Number of Holdings (excluding cash) | 46 |

| Holding |

Percent |

| Doosan Enerbility Co., Ltd. |

5.56% |

| BHP Group Limited |

5.32% |

| Mitsubishi Heavy Industries, Ltd. |

5.14% |

| GE Vernova Inc. |

5.03% |

| Cameco Corp. |

4.70% |

| Entergy Corporation |

4.47% |

| BWX Technologies, Inc. |

4.43% |

| The Southern Company |

4.37% |

| Duke Energy Corporation |

4.36% |

| Rolls-Royce Holdings Plc |

4.35% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $195,778 |

| Median Market Cap. | $13,520 |

| Minimum Market Cap. | $1,357 |

| Price/Earnings | 22.76 |

| Price/Book | 3.57 |

| Price/Cash Flow | 12.09 |

| Price/Sales | 2.30 |

| Country |

Percent |

| United States |

41.60% |

| Japan |

14.01% |

| Canada |

11.89% |

| South Korea |

8.68% |

| Australia |

7.12% |

| China |

6.47% |

| United Kingdom |

6.10% |

| Czech Republic |

2.38% |

| Finland |

1.31% |

| Hong Kong |

0.44% |

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

105 |

36 |

--- |

--- |

| Days Traded at Discount |

2 |

3 |

--- |

--- |

|

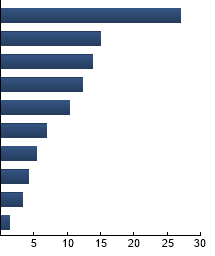

Electric Utilities

|

27.05%

|

|

Electrical Equipment

|

14.96%

|

|

Oil, Gas & Consumable Fuels

|

13.86%

|

|

Aerospace & Defense

|

12.33%

|

|

Independent Power and Renewable Electricity Producers

|

10.34%

|

|

Machinery

|

6.95%

|

|

Metals & Mining

|

5.33%

|

|

Industrial Conglomerates

|

4.20%

|

|

Construction & Engineering

|

3.30%

|

|

Electronic Equipment, Instruments & Components

|

1.40%

|

|

|

Tracking Index: Bloomberg Nuclear Power Total Return Index

MSCI ACWI Index - The Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|