|

|

|

|

Investment Objective/Strategy - The First Trust Indxx NextG ETF, formerly First Trust Nasdaq Smartphone Index Fund, seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an equity index called the Indxx 5G & NextG Thematic Index SM. The Fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- The index is designed to track the performance of companies that have devoted, or have committed to devote, material resources to the research, development and application of fifth generation ("5G") and next generation digital cellular technologies as they emerge.

- Eligible securities must have a minimum market capitalization of $500 million, six-month average daily trading volume of at least $2 million ($1 million for emerging market companies), traded for at least 90% of the total trading days in the last six months or for a security recently issued in an initial public offering over the prior three months, a minimum free float of 10% of shares outstanding and a share price of less than $10,000 for new index constituents.

- All eligible securities are analyzed by Indxx and classified into one of two sub-themes based on their exposure to 5G and/or next generation technology, either 5G Infrastructure & Hardware or Telecommunications Service Providers:

- 5G Infrastructure & Hardware consists of Data Center REITs, Cell Tower REITs, Equipment Manufacturers, Network Testing and Validation Equipment and Software Companies and Mobile Phone Manufacturers.

- Telecommunications Service Providers consist of companies that operate the mobile cellular and wireless communication networks that offer access to 5G networks.

- Eligible securities are ranked by market capitalization and up to 100 securities with the largest market capitalizations are selected. 80% of the index weight is allocated to 5G Infrastructure & Hardware and 20% of the index weight is allocated to Telecommunications Service Providers. The companies are then equally weighted within each sub-theme.

- The index is reconstituted and rebalanced semi-annually.

| Ticker | NXTG |

| Fund Type | Technology |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33737K205 |

| ISIN | US33737K2050 |

| Intraday NAV | NXTGIV |

| Fiscal Year-End | 09/30 |

| Exchange | Nasdaq |

| Inception | 2/17/2011 |

| Inception Price | $30.11 |

| Inception NAV | $30.11 |

| Rebalance Frequency | Semi-Annual |

| Total Expense Ratio* | 0.70% |

* As of 2/2/2026

| Closing NAV1 | $118.23 |

| Closing Market Price2 | $118.59 |

| Bid/Ask Midpoint | $118.63 |

| Bid/Ask Premium | 0.34% |

| 30-Day Median Bid/Ask Spread3 | 0.25% |

| Total Net Assets | $443,377,355 |

| Outstanding Shares | 3,750,002 |

| Daily Volume | 2,631 |

| Average 30-Day Daily Volume | 8,767 |

| Closing Market Price 52-Week High/Low | $119.35 / $74.67 |

| Closing NAV 52-Week High/Low | $119.06 / $75.11 |

| Number of Holdings (excluding cash) | 101 |

| Holding |

Percent |

| Samsung Electronics Co., Ltd. |

2.03% |

| Micron Technology, Inc. |

1.88% |

| ASE Technology Holding Co., Ltd. |

1.70% |

| Renesas Electronics Corporation |

1.65% |

| Delta Electronics Inc. |

1.56% |

| MediaTek Inc. |

1.56% |

| STMicroelectronics NV |

1.54% |

| United Microelectronics Corporation |

1.51% |

| Equinix, Inc. |

1.50% |

| LG Electronics Inc. |

1.49% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $4,644,268 |

| Median Market Cap. | $35,779 |

| Minimum Market Cap. | $7,086 |

| Price/Earnings | 23.06 |

| Price/Book | 2.71 |

| Price/Cash Flow | 10.92 |

| Price/Sales | 1.81 |

| Country |

Percent |

| United States |

34.29% |

| Taiwan |

11.49% |

| Japan |

9.82% |

| South Korea |

6.17% |

| India |

5.61% |

| China |

4.44% |

| Italy |

3.46% |

| Finland |

2.67% |

| Sweden |

2.55% |

| United Kingdom |

2.54% |

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

40 |

20 |

--- |

--- |

| Days Traded at Discount |

210 |

10 |

--- |

--- |

|

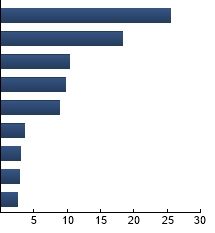

Semiconductors

|

25.52%

|

|

Integrated Telecommunication Services

|

18.34%

|

|

Communications Equipment

|

10.40%

|

|

Technology Hardware, Storage & Peripherals

|

9.71%

|

|

Wireless Telecommunication Services

|

8.90%

|

|

Telecom Tower REITs

|

3.65%

|

|

Electronic Components

|

3.02%

|

|

Data Center REITs

|

2.86%

|

|

Consumer Electronics

|

2.53%

|

|

|

Tracking Index: Indxx 5G & NextG Thematic Index

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| NXTG |

12.55% |

2.65 |

0.97 |

1.26 |

0.84 |

| MSCI ACWI Information Technology Index |

17.89% |

8.07 |

1.25 |

1.39 |

0.76 |

| MSCI ACWI Index |

10.87% |

--- |

1.00 |

1.24 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

MSCI ACWI Information Technology Index - The Index is a free float-adjusted market capitalization-weighted index that is designed to measure the information technology sector performance of developed and emerging markets. MSCI ACWI Index - The Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|