|

|

|

|

Investment Objective/Strategy - The First Trust Enhanced Short Maturity ETF is an actively managed exchange-traded fund. The fund's investment objective is to seek current income, consistent with preservation of capital and daily liquidity.

There can be no assurance that the Fund's investment objectives will be achieved.

- The First Trust Enhanced Short Maturity ETF uses an actively managed strategy that invests in short-duration securities, which are primarily U.S. dollar-denominated, investment-grade securities.

- The fund will be invested across a broad range of asset classes to maintain diversification and at least 80% of the fund's assets will be investment-grade securities at the time of purchase.

- The fund will utilize a short-duration strategy that may offer the potential for enhanced income, while focusing on preservation of capital and daily liquidity.

| Ticker | FTSM |

| Fund Type | Short Maturity |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33739Q408 |

| ISIN | US33739Q4082 |

| Intraday NAV | FTSMIV |

| Fiscal Year-End | 10/31 |

| Exchange | Nasdaq |

| Inception | 8/5/2014 |

| Inception Price | $60.00 |

| Inception NAV | $60.00 |

| Total Expense Ratio* | 0.44% |

* As of 3/3/2025

The Investment Advisor has implemented fee breakpoints, which reduce the fund's investment management fee at certain assets levels. Please see the fund's Statement of Additional Information for full details.

| Closing NAV1 | $60.05 |

| Closing Market Price | ---- |

| Bid/Ask Midpoint | ----- |

| 30-Day Median Bid/Ask Spread2 | 0.02% |

| Total Net Assets | $6,205,922,130 |

| Outstanding Shares | 103,349,724 |

| Average 30-Day Daily Volume | 815,431 |

| Closing Market Price 52-Week High/Low | $60.13 / $59.73 |

| Closing NAV 52-Week High/Low | $60.12 / $59.73 |

| Number of Holdings (excluding cash) | 606 |

| Holding |

Percent |

| U.S. Treasury Note, 3.75%, due 04/30/2027 |

1.20% |

| AUTONATION INC 0%, due 12/22/2025 |

1.05% |

| ENERGY TRANSFER LP 0%, due 12/22/2025 |

0.79% |

| HCA INC 0%, due 12/22/2025 |

0.69% |

| CABOT CORP 0%, due 12/22/2025 |

0.65% |

| DUKE ENERGY CORPORATION 0%, due 12/22/2025 |

0.60% |

| BANK OF NY MELLON CORP Variable rate, due 04/26/2027 |

0.57% |

| CROWN CASTLE INC 4.45%, due 02/15/2026 |

0.57% |

| FIDELITY NATL INFO SERV 1.15%, due 03/01/2026 |

0.56% |

| PRA HEALTH SCIENCES INC 2.875%, due 07/15/2026 |

0.55% |

* Excluding cash.

Holdings are subject to change.

|

Percent |

| Fixed-Rate Corporate Bonds |

46.66% |

| Commercial Paper |

20.84% |

| Asset Backed Securities |

16.10% |

| CLOs |

5.53% |

| Mortgage Backed Securities |

3.02% |

| Yankee CD |

2.16% |

| Floating-Rate Corporate Bonds |

1.95% |

| Commercial Mortgage Backed Securities |

1.85% |

| Government Bonds and Notes |

1.35% |

| Collateralized Mortgage Obligation |

0.54% |

| Cash |

0.00% |

Please note that percentage of 0.00 indicates an amount less than 0.01%.

Past performance is not indicative of future results.

| Weighted Average Effective Duration7 | 0.64 Years |

| Weighted Average Maturity | 0.88 Years |

| Weighted Average Yield-to-Worst8 | 4.09% |

Calculated based on market value of invested assets plus settled cash position.

| Credit Quality |

Percent |

| Government & Agency |

3.40% |

| Cash |

0.00% |

| AAA |

22.64% |

| AA+ |

0.52% |

| AA |

1.16% |

| AA- |

6.87% |

| A+ |

4.55% |

| A |

3.87% |

| A- |

7.81% |

| BBB+ |

14.82% |

| BBB |

10.15% |

| BBB- |

2.97% |

| A-1 (short-term) |

7.91% |

| A-2 (short-term) |

11.97% |

| A-3 (short term) |

1.36% |

The ratings are by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody's Investors Service, Inc., Fitch Ratings, or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Ratings are measured highest to lowest on a scale that generally ranges from AAA to D for long-term ratings and A-1 to C for short-term ratings. Investment grade is defined as those issuers that have a long-term credit rating of BBB- or higher or a short-term credit rating of A-3 or higher. "NR" indicates no rating. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. U.S. Treasury, U.S. Agency and U.S. Agency mortgage-backed securities appear under "Government". Credit ratings are subject to change. Please note that percentage of 0.00 indicates an amount less than 0.01%.

| Years |

Percent |

| 1-30 days |

16.52% |

| 31-90 days |

4.32% |

| 3-6 months |

13.87% |

| 6-12 months |

23.35% |

| 1-2 years |

28.29% |

| 2-3 years |

11.69% |

| >3 years |

1.96% |

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

97 |

42 |

36 |

35 |

| Days Traded at Discount |

155 |

18 |

26 |

29 |

|

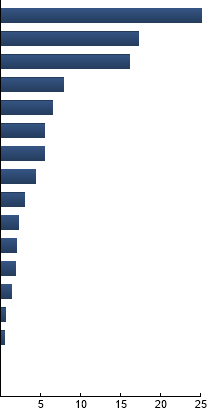

Financial

|

25.15%

|

|

Consumer, Non-cyclical

|

17.31%

|

|

ABS

|

16.10%

|

|

Industrial

|

7.90%

|

|

Energy

|

6.54%

|

|

CLO

|

5.53%

|

|

Technology

|

5.45%

|

|

Consumer, Cyclical

|

4.40%

|

|

Whole Loan

|

3.02%

|

|

Communications

|

2.29%

|

|

Utilities

|

1.95%

|

|

CMBS

|

1.85%

|

|

Government

|

1.35%

|

|

Basic Materials

|

0.62%

|

|

CMO

|

0.54%

|

|

CASH

|

0.00%

|

|

Pool

|

0.00%

|

|

|

Please note that percentage of 0.00 indicates an amount less than 0.01%.

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FTSM |

0.37% |

0.16 |

1.05 |

0.59 |

0.80 |

| ICE BofA 0-1 Year US Treasury Index |

0.31% |

--- |

1.00 |

0.16 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Bloomberg US Aggregate Bond Index - The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS. ICE BofA 0-1 Year US Treasury Index - The Index is comprised of U.S. dollar denominated sovereign debt securities publicly issued by the U.S. Treasury in its domestic market with at least one month and less than one year remaining term to final maturity.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|