|

|

|

|

Investment Objective/Strategy - The First Trust Balanced Income ETF (the "Fund") seeks investment results that correspond generally to the price and yield (before the Fund's fees and expenses) of an index called the Bloomberg Moderate Allocation Income Focus Index (the "Index"). Under normal conditions, the Fund will invest at least 80% of its net assets (plus any borrowings for investment purposes) in the exchange-traded funds ("ETFs") that comprise the Index. The ETFs comprising the Index selection universe are advised by First Trust Advisors L.P. ("First Trust"), the Fund's investment advisor.

There can be no assurance that the Fund's investment objectives will be achieved.

- The Bloomberg Moderate Allocation Income Focus Index is constructed to track a portfolio of income-generating First Trust ETFs across three asset classes:

- Equity Linked ETFs (the “Equity Allocation”)

- Fixed Income ETFs (the “Fixed Income Allocation”).

- Commodity Linked Income ETFs (the “Commodity Allocation”)

- According to the index provider, under normal market conditions, FTBI will allocate its assets across the below allocations.

- Equity Allocation (60%): The equity allocation includes First Trust ETFs that seek to generate income through the use of either a “buywrite” investing strategy or a “target income” investing strategy and are categorized as the following, based upon the index provider’s style classification of the underlying equity securities to which the underlying ETFs invest or have exposure:

- Core - Companies that have characteristics of both growth and value companies and have higher levels of correlation to the broader market.

- Growth - Companies that are experiencing significant growth and have the potential for continued expansion.

- Value - Companies that are perceived to be undervalued relative to their share price.

- The index allocates the Equity Allocation equally among the underlying ETFs comprising the three styles. The underlying ETFs within each style are then equally weighted.

- Fixed Income Allocation (35%): The fixed income allocation includes First Trust ETFs that invest in investment grade fixed income securities and are categorized and weighted as the following based upon the index provider’s classification of the type of securities comprising each underlying ETF’s portfolio:

- Core (14%) – Provide coverage in multiple sectors including government, securitized and corporate bond sector.

- Investment grade (8.75%) - Primarily focused on the corporate bond sector.

- Government (12.25%) - Primarily focused on securities issued by the U.S. government, its agencies or instrumentalities, including securitized bonds issued by such entities.

- The index provider further sub-classifies the underlying ETF within the core, investment grade and government style groups by short, medium, or long duration and the weight is then equally allocated among each underlying ETF comprising each duration group.

- Commodity Allocation (5%): The commodity allocation includes First Trust ETFs that derive exposure to commodities through investments in FLexible EXchange Options (“FLEX Options”) that reference an exchange-traded product that invests directly in gold. The Commodity Linked ETF seeks to provide a specific level of income that is tied to the annual yield of one-month U.S. Treasury securities (before fees and expenses).

- The index is reconstituted and rebalanced semi-annually.

| Ticker | FTBI |

| Fund Type | Multi Asset Income |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33738R571 |

| ISIN | US33738R5717 |

| Intraday NAV | FTBIIV |

| Fiscal Year-End | 03/31 |

| Exchange | NYSE Arca |

| Inception | 5/28/2025 |

| Inception Price | $19.93 |

| Inception NAV | $19.93 |

| Rebalance Frequency | Semi-Annual |

| Management Fees | 0.25% |

| Acquired Fund Fees and Expenses | 0.72% |

| Total Expense Ratio | 0.97% |

As of Date 5/29/2025

| Closing NAV1 | $21.75 |

| Closing Market Price2 | $21.73 |

| Bid/Ask Midpoint | $21.75 |

| Bid/Ask Premium | 0.00% |

| 30-Day Median Bid/Ask Spread3 | 0.42% |

| Total Net Assets | $18,491,652 |

| Outstanding Shares | 850,002 |

| Daily Volume | 4,152 |

| Average 30-Day Daily Volume | 4,393 |

| Closing Market Price 52-Week High/Low | $21.89 / $19.93 |

| Closing NAV 52-Week High/Low | $21.88 / $19.93 |

| Number of Holdings (excluding cash) | 14 |

| Holding |

Percent |

| First Trust BuyWrite Income ETF |

19.53% |

| FT Vest Technology Dividend Target Income ETF |

9.87% |

| First Trust Nasdaq BuyWrite Income ETF |

9.61% |

| FT Vest S&P 500® Dividend Aristocrats Target Income ETF® |

6.97% |

| FT Vest SMID Rising Dividend Achievers Target Income ETF |

6.96% |

| First Trust Core Investment Grade ETF |

6.95% |

| First Trust Smith Opportunistic Fixed Income ETF |

6.94% |

| FT Vest Rising Dividend Achievers Target Income ETF |

6.67% |

| FT Vest Gold Strategy Target Income ETF® |

5.66% |

| First Trust Intermediate Duration Investment Grade Corporate ETF |

4.30% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

68 |

8 |

--- |

--- |

| Days Traded at Discount |

82 |

31 |

--- |

--- |

|

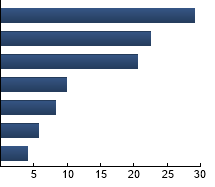

Equity Core

|

29.15%

|

|

Investment Grade Fixed income

|

22.48%

|

|

Equity Value

|

20.60%

|

|

Equity Growth

|

9.87%

|

|

Government Fixed Income

|

8.20%

|

|

Commodities

|

5.66%

|

|

Core Fixed income

|

4.04%

|

|

|

Tracking Index: Bloomberg Moderate Allocation Income Focus Index

Bloomberg US Aggregate Bond Index - The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS. S&P 500® Index - The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|