|

|

|

|

Investment Objective/Strategy - The First Trust Mid Cap Core AlphaDEX® Fund is an exchange-traded fund. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the Nasdaq AlphaDEX Mid Cap Core™ Index.

There can be no assurance that the Fund's investment objectives will be achieved.

- The Index is an "enhanced" index created and administered by Nasdaq, Inc. ("Nasdaq") which employs the AlphaDEX® stock selection methodology to select stocks from the Nasdaq US 600 Mid Cap™ Index that meet certain criteria.

- Nasdaq constructs the Index by ranking the eligible stocks from the Nasdaq US 600 Mid Cap™ Index on growth factors including 3-, 6- and 12- month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors. A stock must have data for all growth and/or value factors to receive a rank for that style.

- Each stock receives either its growth or value score as its selection score based on its style designation as determined by Nasdaq.

- The top 450 stocks based on the selection score determined in the previous step comprise the "selected stocks". The selected stocks are divided into quintiles based on their rankings and the top ranked quintiles receive a higher weight within the index. The stocks are equally-weighted within each quintile.

- The Index is reconstituted and rebalanced quarterly.

| Ticker | FNX |

| Fund Type | Mid Cap Core |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33735B108 |

| ISIN | US33735B1089 |

| Intraday NAV | FNXIV |

| Fiscal Year-End | 07/31 |

| Exchange | Nasdaq |

| Inception | 5/8/2007 |

| Inception Price | $30.00 |

| Inception NAV | $30.00 |

| Rebalance Frequency | Quarterly |

| Total Expense Ratio* | 0.62% |

| Net Expense Ratio* | 0.62% |

* As of 12/1/2025

Expenses are capped contractually at 0.70% per year, at least through November 30, 2026.

| Closing NAV1 | $127.74 |

| Closing Market Price | ---- |

| Bid/Ask Midpoint | ----- |

| 30-Day Median Bid/Ask Spread2 | 0.16% |

| Total Net Assets | $1,188,009,151 |

| Outstanding Shares | 9,300,002 |

| Average 30-Day Daily Volume | 12,405 |

| Closing Market Price 52-Week High/Low | $130.46 / $94.92 |

| Closing NAV 52-Week High/Low | $130.51 / $94.75 |

| Number of Holdings (excluding cash) | 449 |

| Holding |

Percent |

| Lumentum Holdings Inc. |

0.83% |

| Hecla Mining Company |

0.59% |

| Guardant Health, Inc. |

0.58% |

| Alcoa Corporation |

0.57% |

| Ciena Corporation |

0.57% |

| Abercrombie & Fitch Co. (Class A) |

0.51% |

| EchoStar Corporation (Class A) |

0.49% |

| The Gap, Inc. |

0.48% |

| Madrigal Pharmaceuticals, Inc. |

0.47% |

| PTC Therapeutics, Inc. |

0.46% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $28,805 |

| Median Market Cap. | $7,401 |

| Minimum Market Cap. | $1,785 |

| Price/Earnings | 15.40 |

| Price/Book | 2.09 |

| Price/Cash Flow | 9.92 |

| Price/Sales | 1.21 |

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

132 |

12 |

29 |

23 |

| Days Traded at Discount |

120 |

48 |

33 |

41 |

|

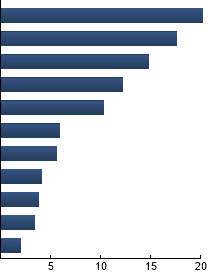

Industrials

|

20.25%

|

|

Financials

|

17.61%

|

|

Consumer Discretionary

|

14.83%

|

|

Health Care

|

12.18%

|

|

Information Technology

|

10.34%

|

|

Materials

|

5.92%

|

|

Energy

|

5.59%

|

|

Consumer Staples

|

4.11%

|

|

Utilities

|

3.77%

|

|

Communication Services

|

3.36%

|

|

Real Estate

|

2.04%

|

|

|

Tracking Index: Nasdaq AlphaDEX Mid Cap Core™ Index

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FNX |

19.16% |

0.84 |

1.12 |

0.43 |

0.99 |

| S&P MidCap 400® Index |

17.00% |

--- |

1.00 |

0.39 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Nasdaq US 600 Mid Cap™ Index - The Index is a float adjusted market capitalization weighted index that contains the 600 securities from the mid cap segment of the NASDAQ US Benchmark™ Index. Russell 3000® Index - The Index is comprised of the 3000 largest and most liquid stocks based and traded in the U.S. S&P MidCap 400® Index - The Index is an unmanaged index of 400 stocks used to measure mid cap U.S. stock market performance.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|