|

|

|

|

Investment Objective/Strategy - The FT Vest SMID Rising Dividend Achievers Target Income ETF (the "Fund") seeks to provide investors with current income with a secondary objective of providing capital appreciation. Under normal market conditions, the Fund will pursue its investment objective by investing primarily in U.S. exchange-traded equity securities contained in the Nasdaq US Small-Mid Cap Rising Dividend Achievers™ Index and by utilizing an "option strategy" consisting of writing (selling) U.S. exchange-traded call options on the Russell 2000® Index, or exchange-traded funds that track the Russell 2000® Index.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | SDVD |

| Fund Type | Target Income Strategies® |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | Vest Financial, LLC |

| CUSIP | 33738D820 |

| ISIN | US33738D8204 |

| Intraday NAV | SDVDIV |

| Fiscal Year-End | 10/31 |

| Exchange | Cboe BZX |

| Inception | 8/9/2023 |

| Inception Price | $19.88 |

| Inception NAV | $19.88 |

| Total Expense Ratio* | 0.85% |

* As of 3/3/2025

| Closing NAV1 | $23.30 |

| Closing Market Price2 | $23.34 |

| Bid/Ask Midpoint | $23.32 |

| Bid/Ask Premium | 0.09% |

| 30-Day Median Bid/Ask Spread3 | 0.22% |

| Total Net Assets | $836,332,034 |

| Outstanding Shares | 35,900,002 |

| Daily Volume | 139,974 |

| Average 30-Day Daily Volume | 159,651 |

| Closing Market Price 52-Week High/Low | $23.35 / $17.64 |

| Closing NAV 52-Week High/Low | $23.35 / $17.55 |

| Number of Holdings (excluding cash) | 176 |

| Holding |

Percent |

| Comfort Systems USA, Inc. |

1.72% |

| Weatherford International Plc |

1.33% |

| EnerSys |

1.27% |

| Woodward, Inc. |

1.27% |

| Huntington Bancshares Incorporated |

1.20% |

| Installed Building Products, Inc. |

1.18% |

| EMCOR Group, Inc. |

1.13% |

| InterDigital, Inc. |

1.11% |

| PriceSmart, Inc. |

1.11% |

| Atmus Filtration Technologies Inc. |

1.10% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Maximum Market Cap. | $51,054 |

| Median Market Cap. | $7,757 |

| Minimum Market Cap. | $1,316 |

| Price/Earnings | 16.62 |

| Price/Book | 2.52 |

| Price/Cash Flow | 13.54 |

| Price/Sales | 2.04 |

Market cap and price ratio statistics are for the equity portion of the fund and exclude cash and options.

| Average Monthly Option Overwrite % | 14.39% |

| Average Monthly Upside Participation % | 85.61% |

| Average ATM Short Call Maturity | 7 Days |

Average Monthly Option Overwrite % is the prior calendar month average percentage of the net asset value used for writing of call options against a long position at each monthly call selling date. Average Monthly Upside Participation % is the prior calendar month average percentage of participation in the price returns of the underlying instrument at each monthly call selling date. Average ATM (At the Money) Short Call Maturity reflects the average number of days until expiration of the call options written over the prior calendar month.

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

243 |

25 |

--- |

--- |

| Days Traded at Discount |

7 |

1 |

--- |

--- |

|

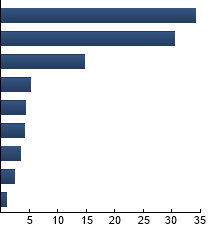

Industrials

|

34.14%

|

|

Financials

|

30.49%

|

|

Consumer Discretionary

|

14.64%

|

|

Technology

|

5.28%

|

|

Energy

|

4.34%

|

|

Consumer Staples

|

4.22%

|

|

Basic Materials

|

3.47%

|

|

Health Care

|

2.50%

|

|

Telecommunications

|

1.11%

|

|

|

Nasdaq US Small Mid Cap Rising Dividend Achievers™ Index - The Index is composed of high quality, small- and mid-capitalization companies with a history of raising their dividends while exhibiting the characteristics to continue to do so in the future. Russell 2000® Index - The Index is comprised of the smallest 2000 companies in the Russell 3000 Index. Russell 3000® Index - The Index is comprised of the 3000 largest and most liquid stocks based and traded in the U.S.

There is no guarantee that the fund's income target will be achieved. The fund does not seek to achieve any specific level of total return performance compared with the total return performance of the Index or the Russell 2000® Index. Capital appreciation on the securities held by the fund may be less than the capital appreciation of the Index and/or the Russell 2000® Index, and the total return performance of the fund may be less than the total return performance of the Index and/or the Russell 2000® Index.

An option is a contractual obligation between a buyer and a seller. There are two types of options known as "calls" and "puts." The buyer of a call option has the right, but not the obligation, to purchase an agreed upon quantity of an underlying asset from the writer (seller) of the option at a predetermined price (the strike price) within a certain window of time (until the option's expiration), creating a long position.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|