|

|

|

|

Investment Objective/Strategy - First Trust Ultra Short Duration Municipal ETF seeks to provide federally tax-exempt income consistent with capital preservation. Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets (including investment borrowings) in municipal debt securities that pay interest that is exempt from regular federal income taxes.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | FUMB |

| Fund Type | Tax-Free Fixed Income |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| CUSIP | 33740J104 |

| ISIN | US33740J1043 |

| Intraday NAV | FUMBIV |

| Fiscal Year-End | 07/31 |

| Exchange | NYSE Arca |

| Inception | 11/1/2018 |

| Inception Price | $20.00 |

| Inception NAV | $20.00 |

| Total Expense Ratio* | 0.45% |

| Net Expense Ratio* | 0.29% |

* As of 1/1/2026

First Trust has contractually agreed to waive management fees of 0.16% of average daily net assets until November 28, 2026.

| Closing NAV1 | $20.09 |

| Closing Market Price2 | $20.10 |

| Bid/Ask Midpoint | $20.09 |

| Bid/Ask Premium | 0.00% |

| 30-Day Median Bid/Ask Spread (as of 1/22/2026)3 | 0.05% |

| Total Net Assets | $238,102,202 |

| Outstanding Shares | 11,850,002 |

| Daily Volume | 36,028 |

| Average 30-Day Daily Volume | 102,416 |

| Closing Market Price 52-Week High/Low | $20.17 / $20.00 |

| Closing NAV 52-Week High/Low | $20.17 / $20.01 |

| Number of Holdings (excluding cash) | 223 |

| Holding |

Percent |

| NATIONAL FIN AUTH NH SOL WST DISP REV Variable rate, due 07/01/2033 |

1.49% |

| MIAMI-DADE CNTY FL SCH BRD CTFS PARTN N/C, 5%, due 05/01/2026 |

1.15% |

| DALLAS-FORT WORTH TX INTL ARPT REV N/C, 5%, due 11/01/2027 |

0.88% |

| MASSACHUSETTS ST PORT AUTH N/C, 5%, due 07/01/2027 |

0.88% |

| BURLESON TX INDEP SCH DIST 4%, due 08/01/2038 |

0.87% |

| MIAMI-DADE CNTY FL WTR & SWR REV N/C, 5%, due 10/01/2026 |

0.87% |

| N TX TOLLWAY AUTH REVENUE N/C, 5%, due 01/01/2027 |

0.87% |

| NEW JERSEY ST ECON DEV AUTH REV 5.25%, due 09/01/2026 |

0.87% |

| OHIO ST AIR QUALITY DEV AUTH Variable rate, due 11/01/2039 |

0.86% |

| SALT LAKE CITY UT ARPT REVENUE N/C, 5%, due 07/01/2026 |

0.86% |

* Excluding cash.

Holdings are subject to change.

| State |

Percent |

| TX |

13.11% |

| NJ |

7.30% |

| FL |

7.10% |

| NY |

6.78% |

| IL |

6.27% |

| OH |

5.67% |

| IN |

5.51% |

| MA |

4.73% |

| AL |

4.67% |

| NC |

3.52% |

Past performance is not indicative of future results.

| Weighted Average Effective Duration11 | 0.63 Years |

| Weighted Average Modified Duration12 | 0.63 Years |

| Weighted Average Maturity | 0.68 Years |

| Weighted Average Price | $101.16 |

| Weighted Average Coupon | 4.55% |

| Weighted Average Yield-to-Worst13 | 2.77% |

Portfolio information statistics exclude cash and other assets and liabilities.

| Years |

Percent |

| Cash |

-0.73% |

| 0 - 0.99 Years |

77.34% |

| 1 - 1.99 Years |

23.02% |

| 2 - 2.99 Years |

0.37% |

| Credit Quality |

Percent |

| Cash |

-0.73% |

| AAA |

5.09% |

| AA |

43.58% |

| A |

25.88% |

| BBB |

3.41% |

| BB |

0.96% |

| NR |

2.13% |

| SP-1+ (short-term) |

7.25% |

| SP-1/MIG1 (short-term) |

12.43% |

The credit quality information presented reflects the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody's Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

151 |

8 |

--- |

--- |

| Days Traded at Discount |

99 |

7 |

--- |

--- |

|

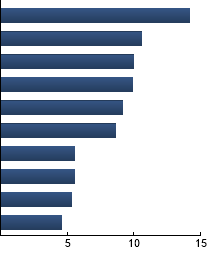

GO-UNLTD

|

14.16%

|

|

GO-LTD

|

10.58%

|

|

INSURED

|

10.01%

|

|

HOSPITAL

|

9.89%

|

|

Airport

|

9.17%

|

|

IDB

|

8.64%

|

|

GAS

|

5.55%

|

|

DEDICATED TAX

|

5.53%

|

|

LOCAL HSG

|

5.30%

|

|

COP

|

4.61%

|

|

|

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FUMB |

0.62% |

0.03 |

1.19 |

-2.98 |

0.97 |

| Bloomberg Municipal Short-Term Index |

0.50% |

--- |

1.00 |

-3.13 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Bloomberg Municipal Bond Index - The Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. Bloomberg Municipal Short-Term Index - The Index is a subset of the Bloomberg Municipal Bond Index that measures the performance of investment-grade municipal bond issues with remaining maturities of 0 to 1 years.

|

|

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

|