Investment Objective/Strategy - The First Trust Preferred Securities and Income ETF is an actively managed exchange-traded fund. The fund's investment objective is to seek total return and to provide current income. Under normal market conditions, the fund invests at least 80% of its net assets (including investment borrowings) in preferred securities and income-producing debt securities including corporate bonds, high yield securities and convertible securities.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | FPE |

| Fund Type | Preferred Income |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | Stonebridge Advisors LLC |

| CUSIP | 33739E108 |

| ISIN | US33739E1082 |

| Intraday NAV | FPEIV |

| Fiscal Year-End | 10/31 |

| Exchange | NYSE Arca |

| Inception | 2/11/2013 |

| Inception Price | $19.99 |

| Inception NAV | $19.99 |

| Total Expense Ratio* | 0.85% |

* As of 3/3/2025

The Investment Advisor has implemented fee breakpoints, which reduce the fund's investment management fee at certain assets levels. Please see the fund's Statement of Additional Information for full details.

| Closing NAV1 | $17.71 |

| Closing Market Price2 | $17.75 |

| Bid/Ask Midpoint | $17.75 |

| Bid/Ask Premium | 0.23% |

| 30-Day Median Bid/Ask Spread3 | 0.06% |

| Total Net Assets | $5,908,774,461 |

| Outstanding Shares | 333,705,000 |

| Daily Volume | 2,104,387 |

| Average 30-Day Daily Volume | 1,624,484 |

| Closing Market Price 52-Week High/Low | $18.22 / $16.93 |

| Closing NAV 52-Week High/Low | $18.19 / $17.01 |

| Number of Holdings (excluding cash) | 252 |

| Holding |

Percent |

| BANK OF AMERICA CORP Variable rate |

2.83% |

| Wells Fargo & Company, Series L, 7.500% |

2.19% |

| BARCLAYS PLC Variable rate |

1.79% |

| JPMORGAN CHASE & CO Variable rate |

1.68% |

| GOLDMAN SACHS GROUP INC Variable rate |

1.31% |

| GLOBAL ATLANTIC Variable rate, due 10/15/2051 |

1.30% |

| CREDIT AGRICOLE SA Variable rate |

1.29% |

| LLOYDS BANKING GROUP PLC Variable rate |

1.24% |

| CHARLES SCHWAB CORP Series H, Variable rate |

1.18% |

| Nextera Energy Capital Holdings, Inc., Series U, 6.50%, Due 06/01/2085 |

1.17% |

* Excluding cash.

Holdings are subject to change.

| Country |

Percent |

| United States |

58.94% |

| Canada |

13.53% |

| United Kingdom |

7.55% |

| France |

6.25% |

| Spain |

2.89% |

| Bermuda |

2.20% |

| Germany |

1.87% |

| Japan |

1.72% |

| Cayman Islands |

1.43% |

| The Netherlands |

1.10% |

Past performance is not indicative of future results.

Among 66 funds in the Preferred Stock category. This fund was rated 3 stars/66 funds (3 years), 4 stars/56 funds (5 years), 4 stars/38 funds (10 years) based on risk adjusted returns.

Among 66 funds in the Preferred Stock category. This fund was rated 3 stars/66 funds (3 years), 4 stars/56 funds (5 years), 4 stars/38 funds (10 years) based on risk adjusted returns.

| Weighted Average Effective Duration9 | 5.26 Years |

| Weighted Average Yield-to-Worst10 | 6.93% |

| % Institutional Securities (e.g. $1000 par)11 | 73.94% |

| % Retail Securities (e.g. $25 par)12 | 26.06% |

| Weighted Average % of Par14 | 97.96% |

| CoCo/AT1 Exposure15 | 22.57% |

| Regional Bank Exposure16 | 1.52% |

| Security |

Percent |

| Fixed-to-Variable Rate Securities |

73.97% |

| Fixed Rate Securities |

24.46% |

| Floating Rate Securities |

1.57% |

| Credit Quality |

Percent |

| A- |

0.88% |

| BBB+ |

15.33% |

| BBB |

28.49% |

| BBB- |

32.24% |

| BB+ |

12.82% |

| BB |

5.96% |

| BB- |

0.20% |

| B- |

1.68% |

| NR |

2.40% |

The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody's Investors Service, Inc., Fitch Ratings, or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

|

2024 |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Days Traded at Premium |

147 |

43 |

43 |

--- |

| Days Traded at Discount |

105 |

17 |

18 |

--- |

|

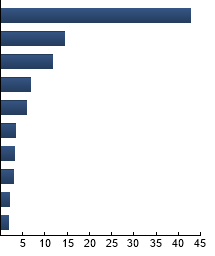

Banks

|

42.67%

|

|

Insurance

|

14.43%

|

|

Capital Markets

|

11.70%

|

|

Electric Utilities

|

6.73%

|

|

Multi-Utilities

|

5.80%

|

|

Oil, Gas & Consumable Fuels

|

3.27%

|

|

Financial Services

|

3.19%

|

|

Wireless Telecommunication Services

|

3.00%

|

|

Food Products

|

1.99%

|

|

Diversified Telecommunication Services

|

1.89%

|

|

|

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FPE |

10.24% |

0.48 |

1.00 |

0.08 |

0.98 |

| ICE BofA US Investment Grade Institutional Capital Securities Index |

6.90% |

2.17 |

0.65 |

0.35 |

0.95 |

| Blended Benchmark |

10.05% |

--- |

1.00 |

0.03 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

ICE BofA US Investment Grade Institutional Capital Securities Index - The Index tracks the performance of US dollar denominated investment grade hybrid capital corporate and preferred securities publicly issued in the US domestic market. Blended Benchmark - The Benchmark consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. The Blended Benchmark is intended to reflect the proportional market cap of each segment of the preferred and hybrid securities market. The Blended Benchmark returns are calculated by using the monthly returns of the four indices during each period shown above. At the beginning of each month the four indices are rebalanced to a 30/30/30/10 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above.

ICE BofA Core Plus Fixed Rate Preferred Securities Index - The Index tracks the performance of fixed rate US dollar denominated preferred securities issued in the US domestic market.

ICE USD Contingent Capital Index - The Index tracks the performance of investment grade and below investment grade contingent capital debt publicly issued in the major domestic and eurobond markets.

ICE BofA US High Yield Institutional Capital Securities Index - The Index tracks the performance of US dollar denominated sub-investment grade hybrid capital corporate and preferred securities publicly issued in the US domestic market.

Bloomberg US Aggregate Bond Index - The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

|

|