Investment Objective/Strategy - The First Trust SSI Strategic Convertible Securities ETF is an actively managed exchange-traded fund that seeks to deliver total return by investing, under normal market conditions, at least 80% of its net assets in a diversified portfolio of U.S. and non-U.S. convertible securities.

There can be no assurance that the Fund's investment objectives will be achieved.

| Ticker | FCVT |

| Fund Type | Convertible Securities |

| Investment Advisor | First Trust Advisors L.P. |

| Investor Servicing Agent | Bank of New York Mellon Corp |

| Portfolio Manager/Sub-Advisor | SSI Investment Management LLC |

| CUSIP | 33739Q507 |

| ISIN | US33739Q5071 |

| Intraday NAV | FCVTIV |

| Fiscal Year-End | 10/31 |

| Exchange | Nasdaq |

| Inception | 11/3/2015 |

| Inception Price | $25.00 |

| Inception NAV | $25.00 |

| Total Expense Ratio* | 0.95% |

* As of 3/3/2025

| Closing NAV1 | $46.09 |

| Closing Market Price2 | $46.07 |

| Bid/Ask Midpoint | $46.06 |

| Bid/Ask Discount | 0.07% |

| 30-Day Median Bid/Ask Spread (as of 2/10/2026)3 | 0.43% |

| Total Net Assets | $112,930,294 |

| Outstanding Shares | 2,450,002 |

| Daily Volume | 4,408 |

| Average 30-Day Daily Volume | 39,180 |

| Closing Market Price 52-Week High/Low | $47.03 / $32.51 |

| Closing NAV 52-Week High/Low | $46.88 / $32.48 |

| Number of Holdings (excluding cash) | 145 |

| Holding |

Percent |

| LUMENTUM HOLDINGS INC Convertible, 0.375%, due 03/15/2032 |

4.17% |

| WESTERN DIGITAL CORP Convertible, 3%, due 11/15/2028 |

2.81% |

| The Boeing Company, Convertible, 6.00%, Due 10/15/2027 |

2.70% |

| ALIBABA GROUP HOLDING Convertible, 0.50%, due 06/01/2031 |

2.08% |

| MORGAN STANLEY FIN LLC Convertible, 0.125%, due 02/07/2028 |

2.00% |

| NEXTERA ENERGY CAPITAL Convertible, 3%, due 03/01/2027 |

1.72% |

| MORGAN STANLEY FIN LLC Convertible, 0.125%, due 04/26/2030 |

1.67% |

| SEAGATE HDD CAYMAN Convertible, 3.50%, due 06/01/2028 |

1.50% |

| Wells Fargo & Company, Series L, 7.500% |

1.43% |

| MKS INC Convertible, 1.25%, due 06/01/2030 |

1.38% |

* Excluding cash.

Holdings are subject to change.

Past performance is not indicative of future results.

| Weighted Average Effective Duration4 | 1.11 Years |

|

Percent |

| Convertible Bond |

82.62% |

| Mandatory Preferred |

9.20% |

| Cash & Equivalent |

5.25% |

| Convertible Preferred |

2.93% |

|

|

2025 |

Q1 2026 |

Q2 2026 |

Q3 2026 |

| Days Traded at Premium |

56 |

10 |

--- |

--- |

| Days Traded at Discount |

194 |

18 |

--- |

--- |

|

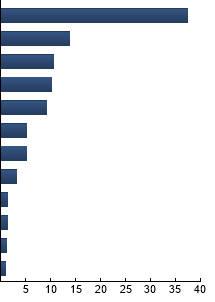

Technology

|

37.39%

|

|

Health Care

|

13.89%

|

|

Financials

|

10.68%

|

|

Industrials

|

10.17%

|

|

Consumer Discretionary

|

9.23%

|

|

Cash & Accrued Income

|

5.25%

|

|

Utilities

|

5.12%

|

|

Materials

|

3.29%

|

|

Energy

|

1.40%

|

|

Transportation

|

1.34%

|

|

Telecommunications

|

1.20%

|

|

Media

|

1.04%

|

|

|

| |

Standard Deviation |

Alpha |

Beta |

Sharpe Ratio |

Correlation |

| FCVT |

12.25% |

-1.39 |

1.19 |

0.72 |

0.98 |

| ICE BofA US Convertible Index |

10.09% |

--- |

1.00 |

0.85 |

1.00 |

Standard Deviation is a measure of price variability (risk). Alpha is an indication of how much an investment outperforms or underperforms

on a risk-adjusted basis relative to its benchmark.Beta is a measure of price variability relative to the market. Sharpe Ratio is a measure

of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Bloomberg US Aggregate Bond Index - The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS. ICE BofA US Convertible Index - The Index measures the return of all U.S. convertibles.

|

|